Option To Purchase Real Estate Tax Treatment

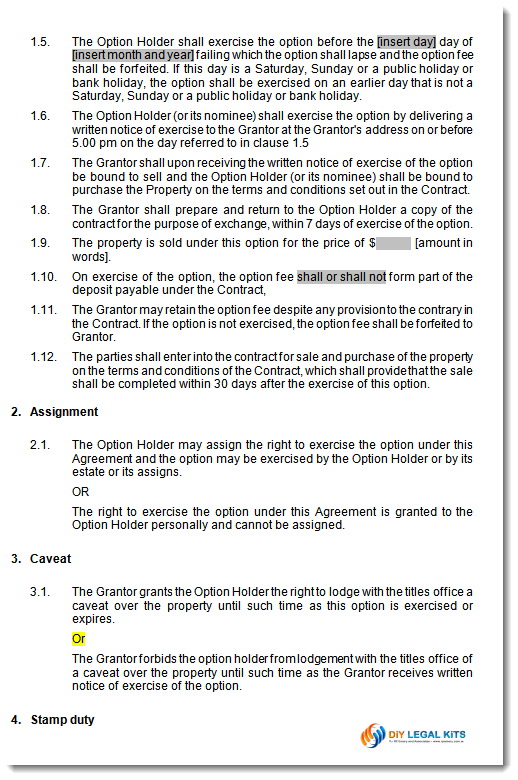

Option to purchase real estate tax treatment. However the outcome and responsibilities are different for the buyer and seller in each situation with respect to. An Option Agreement provides the tenant-option holder the right to purchase the property at an agreed price during the lease term or other specified term also called the Option Period in exchange for a fee paid to the seller called the Option Fee. The payments prior to the purchase remain rent expense to the buyer tenant and rental income to the seller landlord.

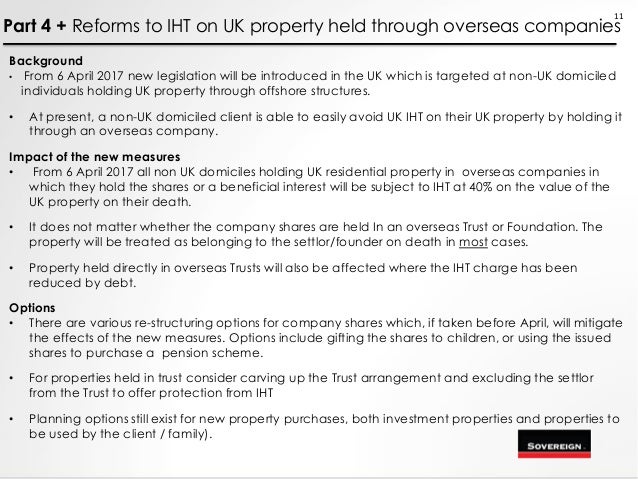

Rental income also contributes to capital gains. CONTRACT FOR PURCHASE SALE OF REAL PROPERTY. An option to purchase real estate is a legally-binding contract that allows a prospective buyer to enter into an agreement with a seller in which the buyer is given the exclusive option to purchase the property for a period of time and for a certain sometimes variable price.

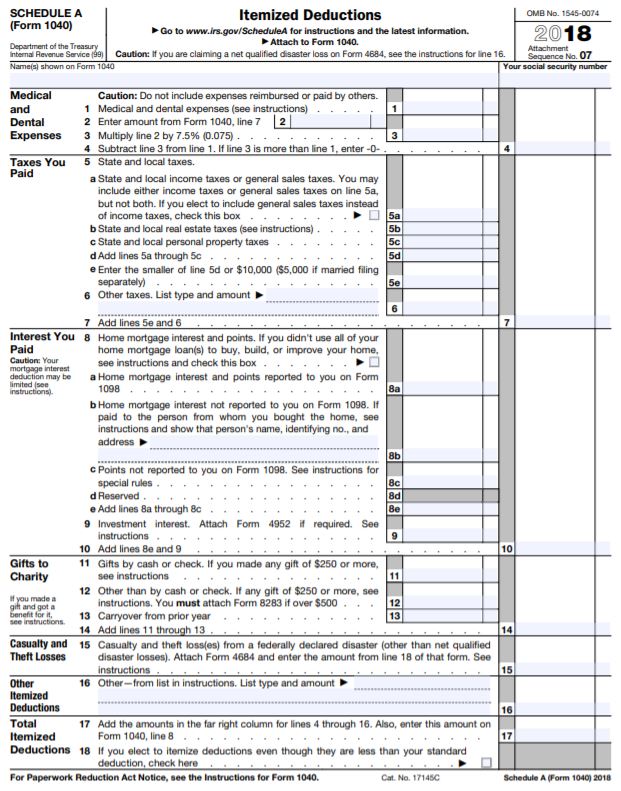

Purchase options involve income tax consequences for both the optionor the person granting the option usually the seller and the optionee the person acquiring the option usually the buyer. Environmental Cleanup Costs. This deduction provides businesses with an incentive to clean up certain sites that are contaminated with hazardous substances.

When you rent a house with an option to buy commonly called a lease purchase option or a rent-to-own arrangement you dont just get an option to buy. 01 Jul 2020 QC 52199. Apart from selling or leasing real estate other CGT events affecting real estate include entering into a terms contract the loss or destruction of an asset granting a right to reside granting renewing or extending an option exercising an option and entering into a conservation covenant.

As for the seller the option payment can be treated as a down payment or initial payment of the transaction. Where the option is a non-arms length non-commercial option see 5 above the provisions of subsection 245 2 will apply where a benefit is indicated at the time the option is exercised. The biggest tax issue with lease options is the timing of the transfer of ownership.

Options generally carry no tax consequences until they are exercised assigned or terminated by agreement or expiration. In the event that the Purchaser exercises its exclusive Option as provided for in the preceding paragraph Seller agrees to sell and Purchaser agrees to buy the Premises and both parties agree to execute a contract for such purchase and sale of the Premises in accordance with the following terms and. Option consideration fees are treated differently for the purposes of taxation depending on whether or not the option is exercised when the option is exercised or expires and the type of property affected by the optionsale.

A lease with an option to purchase also known as a lease option is a common real estate arrangement. Where real estate is inventory to the grantor of an option to acquire the property the proceeds from the granting of the option are income to the grantor.

Where the option is a non-arms length non-commercial option see 5 above the provisions of subsection 245 2 will apply where a benefit is indicated at the time the option is exercised.

Environmental Cleanup Costs. The biggest tax issue with lease options is the timing of the transfer of ownership. When you rent a house with an option to buy commonly called a lease purchase option or a rent-to-own arrangement you dont just get an option to buy. If the IRS determines that the transfer was a lease option the ownership transfer takes place when the purchase option is exercised. Lease Option Contract Tax Treatment A lease option contract is an arrangement in which a party signs a lease agreement with an option to purchase the property by a certain date at a stipulated price. As for the seller the option payment can be treated as a down payment or initial payment of the transaction. Apart from selling or leasing real estate other CGT events affecting real estate include entering into a terms contract the loss or destruction of an asset granting a right to reside granting renewing or extending an option exercising an option and entering into a conservation covenant. In the event that the Purchaser exercises its exclusive Option as provided for in the preceding paragraph Seller agrees to sell and Purchaser agrees to buy the Premises and both parties agree to execute a contract for such purchase and sale of the Premises in accordance with the following terms and. 01 Jul 2020 QC 52199.

The total amount of the payments can ultimately contribute to a capital gain or loss both of which have tax implications. Environmental Cleanup Costs. 1031 Real Estate Exchange. A 1031 real estate exchange enables you to roll the proceeds of one sale into a similar investment opportunity. An Option Agreement provides the tenant-option holder the right to purchase the property at an agreed price during the lease term or other specified term also called the Option Period in exchange for a fee paid to the seller called the Option Fee. Purchase options involve income tax consequences for both the optionor the person granting the option usually the seller and the optionee the person acquiring the option usually the buyer. The biggest tax issue with lease options is the timing of the transfer of ownership.

/lease-options-and-lease-purchase-sales-1798417_FINAL-328c1f1307e54c189cffa55cd6dd5457.png)

/lease-options-and-lease-purchase-sales-1798417_FINAL-328c1f1307e54c189cffa55cd6dd5457.png)

/lease-options-and-lease-purchase-sales-1798417_FINAL-328c1f1307e54c189cffa55cd6dd5457.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/young-man-cleaning-house-with-vacuum-cleaner-964867220-e348c5ffb9774abf8f62ca75f19cb2b1.jpg)

/GettyImages-1184397720-df8f035eb6c840d5b2de9e8f5a1d53f7.jpg)

Posting Komentar untuk "Option To Purchase Real Estate Tax Treatment"