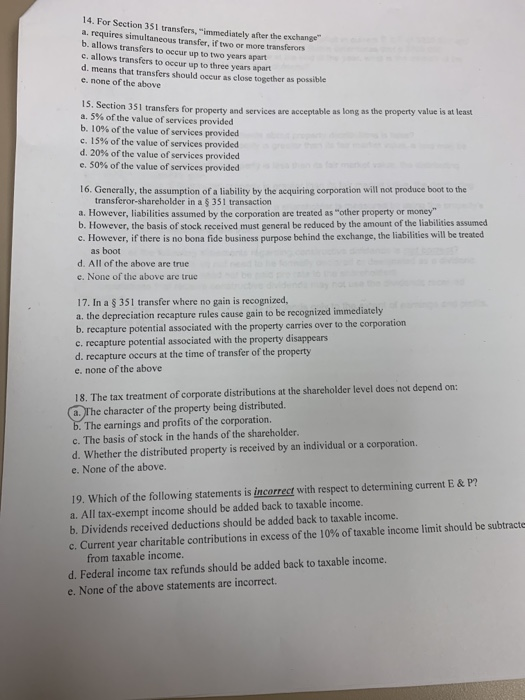

The Tax Treatment Of Corporate Distributions At The Shareholder Level Does Not Depend On:

The tax treatment of corporate distributions at the shareholder level does not depend on:. 12182015 1148 PM Due on. 2000 Posted By. The tax treatment of corporate distributions at the shareholder level does not depend on.

Whether the distributed property is received by an individual or a corporation. The earnings and profits of the corporation. None of the above.

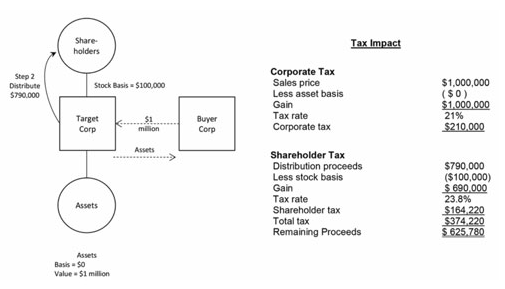

The basis of stock in the hands of the shareholder. A distribution of property made by a regular C corporation to an individual shareholder with respect to the corporations stock a will be treated as a dividend to the extent it does not exceed the corporations earnings and profits. When an S Corporation distributes its income to the shareholders the distributions are tax-free.

None of the. The earnings and profits of the corporation. The tax treatment of corporate distributions at the shareholder level does not depend on.

Whether the distributed property is subject to a liability. The tax treatment of corporate distributions at the shareholder level does not depend on. The earnings and profits of the corporation.

Those that elect the shareholder option are referred to as S corporations. The basis of stock in the hands of the shareholder. CThe basis of stock in the hands of the shareholder.

The tax treatment of corporate distributions at the shareholder level does not depend on. Whether the distributed property is received by an individual or a corporation.

2000 Posted By.

The basis of stock in the hands of the shareholder. Corporations can elect to be taxed at the corporate level or at the shareholder level. The character of the property being distributed. The basis of stock in the hands of the shareholder. The character of the property being distributed. Whether the distributed property is received by an individual or a corporation. The basis of stock in the hands of the shareholder. If the distribution exceeds EP the excess reduces the shareholders stock basis. None of the above.

The basis of stock in the hands of the shareholder. As one of my partners often reminds me the answer to every tax questions is It depends With respect to the taxability of S Corporation distributions. The tax treatment of corporate distributions at the shareholder Offered Price. The character of the property being distributed. 2000 Posted By. BThe earnings and profits of the corporation. B any remaining portion of the distribution will be applied against and will reduce the shareholders adjusted basis for the stock to the extent thereof ie a tax-free return of the shareholder.

/Howarecapitalgainsanddividendstaxeddifferently2-aa1e45473ab6480185b77281959dee5c.png)

Posting Komentar untuk "The Tax Treatment Of Corporate Distributions At The Shareholder Level Does Not Depend On:"